Introduction

You’re obviously here for a reason…

Indexed life insurance has been called “complex” by some. (NOT!) Actually, when you’ve got the lowdown on this protection product, it’s pretty simple. *wink* Now- let’s assume that you don’t know what life insurance is. No worries.

Life insurance is an insurance product that protects individuals against the risk of death. If the insured person(s) die, the insurance company pays out a sum of money.

There are many different types of life insurance to choose from. There are the two broad categories that all life insurance can be placed into: temporary and permanent protection. The first decision one needs to make before deciding which type of insurance is right for them is whether they want temporary or permanent coverage.

Term Life Insurance

- Term Life insurance is a type of temporary protection.

- It provides a benefit that is payable only in the event that the insured dies during the policy term and the policy is also active.

- In general, Term Life does not accumulate cash values, and the policy will terminate if the policyowner quits paying their premiums.

- There are numerous types of Term Life plans available today including Level Term, Decreasing Term, Increasing Term, and Annual Renewable Term.

- One important aspect to take into consideration is that Term Life generally does not last the insured’s entire lifetime, which is why it is considered temporary protection.

- However, this type of insurance is relatively inexpensive as compared to other types of life insurance coverage.

Now on the other hand…there are numerous types of permanent protection available today. Remember that each product has its own advantages and disadvantages, and an agent and client must decide together which plan is best for the given circumstances. TOGETHER! It is important to understand that the synopses below are just an abbreviated, high–level summary of each type of plan, and are not intended to be complete. Please consult your agent for complete details if interested in a particular type of life insurance, or read more about it each type by researching it on Google.

Whole Life Insurance

- Whole Life insurance is a type of permanent protection that provides strong guaranteed cash values.

- As long as the premiums are paid on a Whole Life plan, or there are sufficient cash values, the death benefit will be paid out.

- Many Whole Life plans are participating, which means that dividends may be payable on the policy.

- Once the policy has been active for some time, it is possible for the policy premiums to be paid through the accumulated cash values.

- In addition, policyowners have the option of taking loans against the cash values as well as withdrawals against the dividends of participating plans.

- It generally has a higher cost relative to other types of permanent insurance plans because of the strong guarantees.

- Another disadvantage is that Whole Life is inflexible in nature when it comes to the premiums and death benefits – you must pay the full premium amount either out-of-pocket or through cash values, and you cannot reduce or increase the death benefit amount if necessary.

Interest-Sensitive Whole Life Insurance

- Interest–Sensitive Whole Life insurance is a type of permanent protection that provides guaranteed cash values, but earns interest based on a stated interest rate.

- This type of Whole Life plan, also known as ISWL, is like whole life but has a minimum guaranteed interest rate in addition to a current rate of interest that is credited, which is based on the insurance company’s investment portfolio.

- The advantages and disadvantages of this type of insurance are similar to traditional Whole Life with the exception that the cash values are intended to keep up with inflation.

Indexed Whole Life Insurance

- Indexed Whole Life is a type of permanent protection much like ISWL that provides guaranteed cash values, but earns potential interest that is based on an external index such as the S&P 500®.

- There are not many companies offering Indexed Whole Life today.

- It is inflexible like other Whole Life plans, and generally has a higher cost because of the stronger cash values.

- There are carriers that offer single premium Indexed Whole Life plans, as well as full-pay and short–pay IWL plans.

- Sales of this type of Indexed Life plan are nominal in comparison to Indexed Universal Life.

You still with me? Wake-up. There’s a few more!

Variable Life Insurance

- Variable Life is another type of Whole Life plan, but is registered as a security.

- As long as the premiums are paid on a Variable Life plan, or there are sufficient cash values, the death benefit will be paid out.

- This type of insurance is regulated by the Securities and Exchange Commission (SEC), as the cash values and death benefit fluctuate based on the performance of stocks, bonds, mutual funds, and other investments.

- Very few insurance carriers offer this type of insurance today, but those who do must offer it via a prospectus.

- Note that this product is a securities product rather than a fixed insurance product like the other types of insurance that we have discussed thus far.

- A policyowner controls the fund allocation on a Variable Life product, but they also assume the risk on this plan.

- Variable Life has unlimited upside potential, but unlimited downside protection.

- A consumer can lose their principal due to fluctuations in the market with this type of product.

- A minimum death benefit is provided regardless of policy fund performance, but there is no guarantee on the cash value.

Universal Life Insurance

- Universal Life provides permanent lifetime coverage that is unbundled and flexible.

- Universal Life (UL) was developed in the 1970’s, and provided a revolutionary new way to provide insurance to consumers, so that they could customize their insurance plans.

- This type of insurance provides for minimum guaranteed cash values and death benefits. It also provides current cash values and death benefits based on a current rate of interest that is credited, based on the insurance company’s investment portfolio.

- Universal Life is a permanent type of insurance that provides for lifetime coverage, if performance warrants.The policyowner has no control over the potential interest crediting on this type of product, but the insurance company assumes any risk in the event of a downturn in interest rates.

- The funds that back this type of product are held in the insurance carrier’s general account.

- Therefore, the Universal Life policyholder is always protected by the guaranteed minimum interest rate, regardless of interest rate performance.

- Insurance carriers who sell UL offer it via a life insurance policy, as it is a fixed insurance product.

- Traditional UL is generally used for clients who are more risk averse and value stronger guarantees.

- Universal Life has limited upside potential, stronger guarantees, and downside protection.

- A consumer cannot lose their principal due to fluctuations in the market with this type of product.

Talk about flexibility! Universal Life plans allow for clients to reduce their face amount (amount of life insurance applied for), or increase the amount of coverage, subject to risk assessment/underwriting. Policyowners are given the availability of changing between death benefit options (subject to policy provisions and underwriting).

Additional flexibility is provided through the ability to stop, restart, or change premium amounts. It is possible for the insurance charges to be paid through the accumulated cash values and policyowners also have the option of taking loans and withdrawals against the cash values. It is very important to monitor Universal Life plans because they are interest-sensitive contracts. If a client purchased a UL contract when interest rates were favorable, and the premium level was established based on current rates, then interest rates declined in subsequent years- it is possible that premiums may need to be adjusted down the road.

It is very important to ensure that interest-sensitive contracts are funded appropriately and monitored annually. Doing an annual review of your policy with a life insurance agent is always a fabulous idea! In addition, a popular feature on many types of UL contracts (whether fixed, indexed, or variable) is an Extended No-Lapse Guarantee (ENLG) which guarantees that coverage will remain active, regardless of interest rate performance, as long as a specified premium level is paid. These features can ensure that a UL will not become underfunded as long as the ENLG premiums are paid.

Okay, so now that you’ve got a grasp on the basics of Universal Life, there are several types of Universal Life in addition to the traditional UL that we just discussed.

Indexed Universal Life Insurance

Now, we’re getting-down to the good stuff.

- Indexed Universal Life provides lifetime coverage that is unbundled and flexible, yet earns potential interest that is based on an external index, such as the S&P 500®.

- Universal Life (IUL) was developed in 1997, and was a solution for people who wanted the safety and guarantees of Universal Life, but also wanted a potential for greater interest crediting.

- This permanent type of insurance provides lifetime coverage if performance warrants, as well as minimum guaranteed cash values and death benefits (like traditional Universal Life).

- Minimum guarantees may be slightly lower than traditional UL, in order to compensate for the greater upside crediting potential.

- Upside potential is limited, however.

- The cash values of an IUL are based in-part on one or more indexed crediting method(s) that the client selects.

- In this manner, IUL’s resemble VUL because the client has some control over the policy through the premium allocation (although not all policies give a choice of multiple crediting methods).

- However, like traditional UL, the insurance company assumes any risk in the event of a downturn in interest rates.

- The funds that back this type of product are also held in the insurance carrier’s general account.

- Therefore, the Indexed Universal Life policyholder is always protected by the minimum guarantee, regardless of interest rate performance.

- Insurance carriers who sell this type of product offer it via a life insurance policy, as it is a fixed insurance product.

- This type of product is typically positioned for clients who are risk averse, but want greater potential for indexed gains.

- Indexed UL has greater upside potential (although limited), minimum guarantees, and downside protection.

- A consumer cannot lose their principal due to fluctuations in the market with this type of product.

Heads up! This type of insurance is just like traditional Universal Life in all ways, except for the interest crediting and the minimum guarantees. For more information on those topics, please our section below on IUL Rates. Regardless of the minimum guarantee, a client can never receive less than 0% interest crediting on an Indexed Universal Life plan. Like Universal Life, it is very important to ensure that this interest-sensitive plan is funded appropriately and monitored annually.

Indexed UL is a type of fixed insurance product, and regulated by the state insurance departments for each individual state. It does not require the presentation of a prospectus because it is not a securities product.

Variable Universal Life Insurance

- Variable Universal Life provides lifetime coverage that is unbundled and flexible, and earns potential interest that is based on the performance of stocks, bonds, mutual funds, and other investments.

- Variable Universal Life (VUL) is much like traditional Universal Life, but it has no minimum guaranteed cash values (except on monies a client allocates to a fixed allocation) and unlimited upside potential.

- This permanent type of insurance provides lifetime coverage if performance warrants.

- As long as a VUL has sufficient cash values, the death benefit will be paid out.

- This type of insurance is regulated by the SEC, as the cash values and death benefit fluctuate based on the underlying funds that they client selects.

- Insurance carriers who sell it offer it via a prospectus, as it is a securities product like Variable Life.

- A policyowner controls the fund allocation on a VUL, and they also assume the risk on this plan.

- This type of product is typically positioned for clients who are willing to accept more risk, and less concerned about guarantees.

- Variable Universal Life has unlimited upside potential, no guarantees, and unlimited downside protection (unless an ENLG is attached to the policy).

- A consumer can lose their principal due to fluctuations in the market with this type of product.

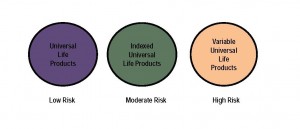

Got it? Great! This means you should have a basic understanding of each of the primary types of life insurance. Now, let’s narrow that discussion down to the three main types of Universal Life insurance for an exercise to educate you on Indexed Universal Life and the likenesses and differences between the primary product lines. In our discussion, we’ll focus on:

- Universal Life (traditional fixed)

- Indexed Universal Life

- Variable Universal Life

Life Insurance Risk Spectrum

|

Guaranteed Interest |

Upside Potential |

Indexed Participation |

Client’s Risk Tolerance |

|

| Fixed (Traditional) |

Typically 2% | Very Limited: typically less than 6.00% | None | Low |

| Indexed | Typically 0% annually with a cumulative guarantee of 1 – 3% | Limited: typically capped at less than 17.00% | Gains based on performance of external index | Moderate |

| Variable | Fixed account only | Unlimited | Gains based directly on fund performance | High |

What is Universal Life (UL)?

A life insurance policy issued by an insurance carrier that guarantees a minimum interest rate with a stated rate of excess interest credited, which is determined by the performance of the insurer’s general account. A Universal Life policy is considered a low risk/low return insurance product.

What is Indexed Universal Life (IUL)?

A life insurance policy issued by an insurance carrier that has a minimum guarantee where crediting of any excess interest is determined by the performance of an external index, such as the Standard and Poor’s 500® index. An Indexed Universal Life policy is considered a moderate risk/moderate return insurance product.

What is Variable Universal Life (VUL)?

A life insurance policy issued by an insurance carrier that has no minimum guarantees, and where crediting of any interest is determined by the performance of underlying investment choices that the policyowner selects. A Variable Universal Life policy is considered a high risk/high return insurance product.

So, we have established that there are several different types of life insurance, the primary categories being Fixed and Variable. These products are all very different, despite the fact that they both may be used for the same purpose. Now that we have seen some of the likenesses in these products above, let’s discuss some of the differences. You ready?

Who carries the risk with this product?

Universal Life

The insurance company must pay out a minimum guaranteed rate of interest, regardless of what they earn on their investments with Universal Life. Let’s take a look:

- A client may purchase a Universal Life policy with a minimum guarantee of 3.00%;

- The UL has a current credited rate of 4.50%;

- If the market “tanks” and the insurance carrier can only earn 2.00% on the money they have invested (i.e. on the bonds and other investments purchased by the insurer at the time the life insurance policy was acquired), the consumer is still protected by the minimum guarantee of 3.00%;

- So, the insurance carrier holds the risk with a Universal Life policy.

Indexed Universal Life

The insurance company must pay out a minimum guarantee, regardless of what they earn on their investments with Indexed Universal Life. Let’s check it out:

- The minimum guarantee on Indexed Life products is lower than those of a traditional Universal Life, but their potential interest crediting is greater;

- A client may purchase an Indexed Universal Life product with a minimum guarantee of 1.00%;

- The maximum credited interest may not exceed a cap of 8.00%;

- If the market “tanks” and the insurance carrier does not earn anything on the money they have invested (i.e. on the bonds and other investments purchased by the insurer at the time the life insurance policy was acquired), the consumer is still protected by the minimum guarantee of 1.00%;

- So, the insurance carrier holds the risk with an Indexed Universal Life policy.

Variable Universal Life

The client invests directly in the underlying funds, and any gain or loss is passed directly to them in whole (less fees and charges). Let’s review:

- There is a potential for loss of principal with a Variable Universal Life, due to poor market performance;

- The variable sub-accounts have no minimum guaranteed interest, but the upside potential is greater than that of traditional Universal Life and Indexed Universal Life products;

- A client may purchase a Variable Universal Life with a minimum guarantee of 1.00% only on the fixed subaccount, and no minimum guarantee on the variable subaccounts;

- Assuming 100% of the premiums are allocated to variable sub-accounts, if the market “tanks,” the insurance carrier bears no risk, but passes it directly to the client;

- So, the client holds the risk with a Variable Universal Life policy.

Regulation

Indexed Universal Life is a fixed insurance product, just as Term, Whole life, and traditional Universal Life are.

- Agents who desire to sell Fixed and Indexed Life products must obtain a life insurance license in the state where they are practicing.

- Insurance carriers, producers, and consumers go through their local state insurance department when they have questions or concerns about Fixed or Indexed Life.

Variable Life and Variable Universal Life are securities products, and thereby regulated by the Securities and Exchange Commission (SEC).

- Agents wanting to sell Variable products must obtain a life insurance license in the state where they are practicing, as well as pass a securities exam(s).

- Insurance carriers, producers, and consumers go through the SEC when they have questions or concerns about Variable Life or Variable Universal Life.

In the securities industry (where products such as Variable Universal Life are sold), salespeople that are licensed to sell securities are regulated by the Financial Industry Regulatory Authority (FINRA) as opposed to the state insurance commissioner.

- FINRA is a self-regulatory organization that oversees the financial regulatory practices of the securities industry.

- In a nutshell, if you are securities licensed, you must abide by the rules of the FINRA as well as the SEC, while the insurance commissioner oversees the solvency of the insurance companies you do business with.

Note that there has never been an Indexed Life product that has been filed as a securities product and registered with the SEC. (Why would there have been? It just doesn’t make too much sense.) Indexed annuities, on the other hand, have had a handful of products that have been registered as securities. Today, there are no registered Indexed Annuity products available for sale. An insurance carrier’s logic for filing an indexed product as a security, as opposed to a fixed product, is usually to accommodate a distribution that is used to selling securities products (and the prospectuses that come with them). To date, sales of registered indexed annuities have been nominal in comparison to total Indexed Annuity sales.

Both Fixed and Variable product types have tight regulation, and rules that the insurance carriers and agents must abide by. The insurance carrier’s products, advertising materials, and training brochures are diligently reviewed in both the Fixed and Variable markets. Agents are required to be properly licensed to sell both types of products. The market conduct of the independent marketing organization, broker/dealer, and agent are all carefully monitored, whether he/she is selling the Fixed or Variable variety of life insurance product.

FINRA’S NOTICE TO MEMBERS 05-50

In August of 2005, FINRA (then known as the National Association of Securities Dealers, or NASD) issued the “Notice to Members 05-50.” This is separate from, but related to, the issue of the SEC’s Rule 151A:

- This notice suggested that broker/dealers (B/Ds) treat Indexed Annuities as if they were securities, despite their fixed insurance status;

- FINRA justified their notice based on their belief that Indexed Annuities might one day be treated as securities, despite the fact that they were treated as insurance at the time the notice was issued;

- For salespeople not selling securities products, NTM 05-50 did not affect their sales practices;

- Alternatively, annuity salespeople with securities licenses were forced to change their sales practices in regard to Indexed Annuities; all sales of Indexed Annuities were to go through their broker/dealer forthwith;

- This meant that a salesperson’s B/D needed to approve the fixed insurance product that he wanted to offer his client, despite the fact that FINRA had no regulatory authority over Indexed Annuities;

- Regardless, salespeople holding securities licenses must abide by the rules of FINRA;

- Therefore, B/Ds began the task of overseeing Indexed Annuity sales for their registered representatives in August of 2005, and still oversee them to this day.

It goes without saying that the securities status of Indexed Annuities has been in question for the majority of their existence, be it one firm or another that is questioning the matter. Fortunately, an agent who sells Indexed Life, securities licensed or not, need not worry about short lists of approved products and losing a portion of their commissions. Yet.

Closing Thoughts

Now you should understand what an Indexed Life product is, who can sell it, and who regulates it. You should also understand quite clearly what an Indexed Life product is not. It is not an alternative to a Variable Universal Life product, as Indexed Life is a safe money place. Variable Universal Life is a risk money place. Indexed Life would be more appropriately viewed as an alternative to Universal Life, Interest-Sensitive Whole Life, or other fixed-rate insurance products. Is life insurance right for you? Only YOU can decide.

Indexed Universal Life Rates

Nearly every Indexed Life product on the market today offers some form of a fixed bucket strategy. This is a premium allocation option that receives credited interest in a manner like that of a traditional Universal Life product. A declared rate is set for the fixed strategy and the client receives that rate if the product is held for the strategy term (usually one year). Many Variable Universal Life products also offer a fixed bucket for clients desiring a more conservative allocation mix. However, the line between Fixed, Indexed, and Variable is drawn when it comes to differentiating how the non-guaranteed rates are credited on these products.

Remember that with a Fixed life product, such as Universal Life, the insurance carrier declares a stated credited rate for the non-guaranteed, current interest rate. Variable Universal Life is very different in that the insurance carrier does not limit the potential gains of the product; the client is investing directly in the market. Therefore, a Variable Universal Life client may realize a gain of 18.00% if the fund they invested in grows that much over a one-year period. With Indexed Universal Life, the insurance carrier purchases options based on an external index’s performance, and the client receives non-guaranteed, current interest that is limited in growth (based on the option price).

Like the handful of indexed crediting methods that can be confusing on some Indexed Life products, the pricing levers that are used to determine the actual rate credited can perplex others. There are three simple pricing levers that are used when calculating potential interest on Indexed products:

- Participation Rate – the percentage of positive index movement in the external index that will be used in the crediting calculation on an Indexed product. (Note that a product with a Participation Rate may also be subject to a Cap and/or Spread.)

- Cap – the maximum interest rate that will be used in the crediting calculation on an Indexed product. (Note that a product with a Cap may also be subject to a Participation Rate and/or Spread.)

- Asset Fee/Spread – a deduction that comes off of the positive index growth at the end of the index term in the crediting calculation on an Indexed product. (Note that a product with a Spread may also be subject to a Participation Rate and/or Cap.)

Now that all of the disclaimers are aside, it can simply be said that most indexed strategies that have a 100% Participation Rate, utilize a Cap as the pricing lever. In turn, most indexed strategies that have greater or less than 100% participation rate utilize only the participation rate as the pricing lever, and do not use a cap. Only one Indexed Universal Life product on the market today has a spread. There are also trends among indexed crediting methods; averaging strategies tend not to have caps more often than others, and will often have more than 100% participation. Annual point-to-point methods generally utilize the participation rate or a cap to limit potential indexed gains. Monthly point-to-point always utilizes a cap.

It is really quite simple when you break it down. For example, on an Indexed UL over a one-year term where the S&P 500 ® has experienced an increase of 20%:

- A Participation Rate of 55% would afford the client potential indexed crediting 11% (20% x 55% = 11%)

- A Cap of 8% would pass on potential gains of 8% to the client (20% limited by an 8% cap)

- A Spread of 3.00% would leave the client with 17% interest credited (20% – 3% = 17%)

Typically, an Indexed UL utilizes only one pricing lever on each strategy. This means that when an insurance carrier changes rates, or the contract comes upon the policy renewal, only the one pricing lever will be adjusted upward or downward. However, an insurance carrier may reserve the right to adjust more than one pricing lever in the event of declining rates if the policy was filed in this manner with the state insurance department. This does not necessarily mean that they alter more than one pricing lever by practice. Generally, the less “moving parts,” the easier the product is to convey to both the agent and client. For that purpose, insurance carriers try to limit the number of variables needed to describe each crediting method.

Indexed Universal Life is like Fixed Universal Life in that it has minimum guarantees to protect the client from a downturn in the market, reductions in current credited rates or caps, etc. These guarantees are very different, on the other hand, from traditional Universal Life. Fixed Universal Life products express their minimum guaranteed rates as a guaranteed annual return rate. If the minimum guarantee is 3.00%, and the rate gets dropped to that level, the insurance carrier will credit 3.00% annually. On an Indexed UL, the product is priced with a less rich guarantee, in order to afford the client higher upside potential interest crediting (as opposed to a Fixed UL). Indexed UL guarantees are typically expressed as Standard Non-Forfeiture (SNF) Minimum Guarantees, which are not paid out annually, but in the event of a trigger. This means that most Indexed Life products today credit zero percent annually, but pay out a stated percentage interest in the event of triggers such as a segment term maturing, death, lapse, surrender, policy maturity, or death. If any of these triggers are to occur, the minimum guarantee is typically credited and compounded.

Minimum guarantees on Indexed Life can generally be placed in three camps today. There are products that do pay a guaranteed annual return, like Fixed Universal Life products. You can expect to see lower upside potential on such products, as the cost of paying a minimum guarantee annually is costly as compared to paying a zero percent annual guarantee. There are products that pay a guaranteed annual return at a rate on both their fixed and indexed strategies, but the rate that is guaranteed on their fixed strategy is more favorable than the guarantee on their indexed strategy. Like the former guarantee, you can expect to see lower upside potential on such products. The third type of minimum guarantee is the most prominent today, the standard non-forfeiture minimum guarantee. There are many variations on this guarantee. Some carriers will pay out a zero percent guarantee annually, and “true-up” their guarantee at the end of a five-year period. Other carriers do not true-up their guarantees until death, lapse, or surrender. Still others do not “true-up” unless death occurs. If guarantees are important in the consideration of which product is appropriate, you should carefully evaluate the minimum guarantees- far beyond the rate. Read exactly how the rate is credited, not just the number, as it may perform differently than you think.

Another very important rate to consider when evaluating which product to purchase, whether Fixed or Indexed, is the renewal rates. These are the new interest crediting rates, caps, etc. that are declared at the end of the interest crediting term (typically one year). Many products today are copied off of another popular carrier’s product. If you want to evaluate the life insurance product beyond the contractual features, and the service and integrity of the insurance carrier; renewal rates should be taken into consideration. That being said, renewal rates are one of the most difficult pieces of information to get your hands on. Very few carriers feel that their renewal rates are an integral part of their sales story, and actually publish marketing pieces publishing these rates. This gives the potential consumer an idea of what the carrier may do to the future rates on the product that they purchase, based on past renewal rate histories.

If you do not have access to renewal rates, it may be helpful to research an Indexed UL’s minimum participation rates and caps, as well as the maximum asset fees. These can be an indicator of just how low the carrier could reduce the rates on the product. Note however, that due to policy filing efficiencies, many carriers opt for unusually low participation rates and caps, and rather high asset fees. (This avoids the cost of potentially re-filing the product in the event that market conditions decline, forcing the carrier to dramatically lower rates.) Often, agents are surprised when they see the maximums and minimums on the pricing levers for Indexed Life products. From a marketing standpoint, it is important to remember that the insurance carriers would most likely discontinue selling the product(s) before rates were ever reduced to these minimums/maximums.

Crediting Methods

Point-to-Point Methods

- Annual Point-to-Point

- Inverse Annual Point-to-Point

- Monthly Point-to-Point

- Two-Year Point-to-Point

- Term End Point

Averaging Methods

- Daily Averaging

- Monthly Averaging

Fixed Methods

- Fixed

- Fixed with Multi-Year Guarantee

History

The First Indexed UL

The first Indexed Life product introduced was the TransDex 500, an Indexed UL that was launched by Transamerica Occidental in January of 1997. Less than four years later, Transamerica had exited the Indexed Life market with a total of only ten carriers in the market at year-end 2000. However, with sales burgeoning on the ten-year anniversary of Indexed Life, the carrier decided to re-enter the market with their new design in January of 2007, TransIndex IUL.

Indexed Life Then vs. Now

Just one year after their introduction, sales of Indexed Life reached $64,717,446 at the close of 1998. Fifteen years later, sales of the product had increased more than 20 times 1998’s levels to a whopping $1,313,981,051 at the end of 2012. Today, fifty carriers compete against one another in the Indexed Life market. Not bad for a product that is less than two decades old!

Selling IUL

Objections

There has to be a specific reason why you aren’t selling Indexed Life today.

- Do you have clients that are willing to give up just a little of the downside guarantees of a traditional Fixed UL product, for some more of the upside?

- Do you have clients that are willing to risk just a little of the downside guarantee for some more of the upside?

If the answer to this question is “yes,” then you should take a look at Indexed Life. As of the close of 2012, there were 50 insurance carriers offering the product and that means plenty of choices for both you and your client.

If you are too comfortable selling the same old product over and over again, get out of that rut! Selling insurance is not a “one product fits all” approach. Different clients certainly have different needs and fall on different areas of the risk spectrum, right?

The number one objection we receive to why an agent doesn’t want to sell Indexed Life? “I like selling Extended No Lapse Guarantees.” Well, guess what? Indexed Life products have ENLGs! As of the second quarter of 2008, more than 38% of the carriers in the IUL market offered Extended No Lapse Guarantees on their products. In fact, the most competitively priced ENLG product in the entire Universal Life market is an Indexed UL. Believe it! So, why aren’t you selling Indexed UL?

Indexed Life offers a variety of product options, guarantees, riders, and even Account Value bonuses. Do you prefer to offer products with preferred loans? Some Indexed UL products offer preferred loans as early as year 6. Maybe you are more interested in premium financing and looking for products with no surrender charge- we’ve got ‘em! Are you an experienced IUL agent and looking for variety in the indexed crediting options on the product you sell? Try an IUL with interest crediting based on an international index. There are riders galore, so you can customize the plan for your client: long term care riders, overloan protection riders, paid-up riders, and all sorts of waivers. It is time to explore all of the possibilities this product has to offer.

But with all of the fabulous options, comes awesome responsibility. Anyone familiar with the Indexed Annuity market is certainly aware of the scrutiny these products have faced in the past few years. As of yet, the fixed insurance status of Indexed Life products has not been threatened. Why? Indexed Life sales are a drop in the bucket compared to Indexed Annuities. As of the close of 2012, Wink, Inc. estimated that Indexed Universal Life sales were only 25% of total Universal Life sales. The product’s popularity is growing due to its tremendous value proposition, but at a much slower pace than Indexed Annuities.

Setting Realistic Expectations

Realistic expectations for indexed crediting on IUL should be set when the policy is presented.

- That means somewhere between 0% and the cap/participation rate/spread.

- Promising double-digit returns on Indexed Universal Life is reckless; any agent who makes such promises is asking for replacement of his book of business, due to product misunderstanding.

- A client that expects double-digit returns needs to readjust their expectations, and revisit their agent.

The Indexed Life market would be full of dissatisfied clients if agents presented the products in this manner, as the results will not come to fruition. Better to under-promise and over-deliver when it comes to Indexed products.

Understanding Illustrated Rates

The National Association of Insurance Commissioners (NAIC) requires that all permanent cash value life insurance products have a signed life insurance illustration at the time of policy delivery (with few exceptions).

An illustration is a projection of (hypothetical) future policy values, based on certain assumptions. These illustrations must project the policy values and death benefits assuming guaranteed charges and guaranteed minimum interest, as well as assuming current charges and current interest. With a traditional Universal Life plan these illustrations are projected at the current interest rate of X%, with X= the current credited interest rate of the UL plan. With Indexed Life, illustrations are more complex, as the insurance carrier has no way to project how the index may/may not perform. The carrier knows what the current participation rates, caps, and spreads of the Indexed Life product are. These rates are used, along with a study of the historical rates of the external index that the crediting method is based upon (such as the S&P 500®), to determine a hypothetical “Illustrated Rate.”

It is important to understand that each carrier has their own methodology for performing their historical study of the index to determine their Illustrated Rate. This methodology, known as an “Illustrated Rate Lookback Method,” is often closely evaluated by agents.

- Today, there are 11 different Illustrated Rate Lookback Methods in the Indexed Life market (including not using a lookback at all).

- This poses a challenge to compare two Indexed Life products on an apples-to-apples basis.

- Two carriers could use the same methodology, but use different dates during the same period to determine their Illustrated Rate. For example, Carrier A and Carrier B may both use a 20-Year Lookback. However, Carrier A might perform their lookback period on the 28th of each month, and Carrier B might perform their lookback on the 15th. This will result in different illustrated rates, and therefore different illustrated values.

Ultimately, the method will assist the insurance carrier in determining a hypothetical Illustrated Rate, which the carrier believes to be a realistic expectation of future performance based on current Indexed Life participation rates, caps, and spreads.

- This Illustrated Rate is used to project the non-guaranteed policy values, and may range from anywhere from around 4.00% to upwards of 10.00%.

- The important thing to understand is that this rate does not represent the actual rate that will be credited to the policy.

- With a Fixed UL, a policyholder can have a reasonable expectation that the rate illustrated at the time of sale is somewhere close to what they may receive in future years (although it still needs monitoring annually, as every interest-sensitive plan does).

- With Indexed UL, it is unknown what will be credited to the policy in future years.

- Some years, the client will receive zero interest credits.

- Some years, they may receive double-digits returns.

- More often than not, they will receive something in between the two.

An Illustrated Rate is the best solution for Indexed Life insurance carriers to be able to project future policy values in a policy illustration, which is required at the point-of-sale.

Heads up! Past performance of an index may not be indicative of future Indexed Life policy performance. Why? Although the Illustrated Rate may have been determined by performing a historical study of an index, past performance is NOT necessarily representative of future results. In other words, if I knew what the S&P 500® was going to be at a year from now, I’d already be rich and not training on Indexed Life!

The day ANY policy is sold, whether it be Fixed UL, Indexed UL, Variable UL, or any other cash value life insurance, the illustration will never come to fruition.

- It is good practice to explain this during the training and sales process.

- Agents learn to set reasonable expectations for their clients, and policyholders learn to monitor their interest-sensitive life insurance.

- If a policyholder forgets to pay a premium, a loan gets taken, or the interest rate drops- this changes all of the values that were projected on the life insurance illustration at issue.

- There are a variety of factors that can change the illustrated values in these projections.

For these reasons, it is important to understand that the illustration is merely a representation of possible values, not a promise of future values.

Anyone familiar with the block of now-underfunded UL contracts that were sold during the high interest rates in the 1980’s should have a deep appreciation for selling Indexed Life responsibly.

- When Universal Life policies were at the height of their prime, they were being sold with credited rates in excess of 12%.

- When the policies were projected assuming the then-current interest rates and premium funding levels, they looked like they would provide cash values and life insurance coverage for the lifetime of the insured.

- But then interest rates crashed, and many policyholders did not alter their premium levels to adjust for the interest rate decline.

- In turn, their cash values declined and many policyholders lost their coverage.

- For those that did not lose their coverage, they received notification that their policy was near lapse and they needed to increase their premiums (sometimes dramatically), in order to keep the coverage active.

This is a risk with any interest-sensitive life insurance plan if the coverage is not monitored regularly by the policyholder and agent. Careful monitoring of annual statements can ensure that the premiums are sufficient to cover the insurance charges and contribute to cash values. It can also ensure that underfunded policies are avoided.

Variable Rate Loans

One feature that has made IUL very popular is the use of Variable Loan Interest (VLI) on policyholder loans. (Note that this feature is not available on all products.) Variable Loan Interest can be a very useful tool when used appropriately and explained properly on any policy, indexed or not. This type of loan interest is usually calculated using a formula that is based on an external index, such as the Moody’s Corporate Bond Yield Average. The rate can fluctuate based on market conditions. If you purchase an Indexed UL and your policy illustration assumes you take out loans using Variable Loan Interest, pay careful attention. It is important to understand that the rate in effect at the time you sign your policy illustration at point-of-sale will likely be different than the rate in effect at the time you initiate the actual policy loan. This can make a significant difference between what your point-of-sale illustration projects your policy values to be, and what you actually receive. Let me explain.

It is possible to have years when your policy may get 0% credited, but you may need to pay loan interest. Your life insurance illustration does not show this, however. The life insurance illustration will assume credited interest at a rate of X% (with X= Illustrated Rate), and Variable Loan Interest at a rate of Y% (with Y= a specified standard illustrated Variable Loan Rate or the current month’s VLI rate). There are many IUL contracts that project an Illustrated Rate that is greater than the Variable Loan Interest rate. So, in these instances, X% is greater than Y%.

Do not mistake this for “making money off of a loan,” as you need to be fully informed on the risks and benefits of your Indexed Universal Life policy, including the maximum loan rate. Just as with an Illustrated Rate, it is important to consider what rate the Variable Rate Loans are illustrated at. Is it current, historic, or somewhere in between, and is it reasonable based on minimums and maximums that could be charged? Make certain that you thoroughly understand the loan provisions of your policy before initiating a policy loan.

Hyperfunded Indexed UL

The following adage applies to many things, including Indexed Life:

“If it sounds too good to be true, it probably is.”

Because many contracts have a Variable Loan provision, and Variable Loan Interest rates are generally much lower than the Illustrated Rate, a concept called “hyperfunding” is emerging in the IUL market. In this scenario, the policyholder pays the premium for a couple of years and then begins taking out loans as well. Why? With a projected Illustrated Rate that is higher than the Variable Loan Interest Rate, the policyholder stands to make a positive spread on loaned money. (i.e. Illustrated Rate of 7.9% – Variable Loan Interest rate of 5.9% = positive net cost of 2.0% to the client) In most instances, there are no taxable consequences to the policyholder. Once projected in the illustration, it may look like it will make the policyholder rich. The problem is that quote up above: If it looks too good to be true, it probably is. In almost all instances, it is. The credited interest rate may end up being lower than the Variable Loan Interest rate- then the client is paying interest, but not receiving any indexed gains on the policy. This results in a negative loan spread, hardly what was illustrated when the hyperfunded scenario was first concocted. Ultimately, the policyholder must ask themselves if they are willing to take such a risk for a hyperfunded strategy.

Equity Harvesting

Equity Harvesting has become a very popular advanced sales concept in the Indexed Life market. In this scenario, policyholders take the equity from their homes and use the money to purchase life insurance. The premise of this sale is that home values always increase, so one should borrow against their home to purchase life insurance. Ultimately, the goal is that both the house and the life insurance policy values will increase over time, resulting in a double gain. Once the policy values have become sufficient, they will be used to make the payments on the home equity loan.

There can be problems with the Equity Harvesting strategy. First, home values have been plummeting since mid-2007. Second, interest rates on home equity loans and mortgages have risen to uncompetitive rates. Third, Indexed Life products are limited in their crediting potential, unlike their Variable UL brethren. The end result can be tragic for a policyholder/homeowner who does not understand the potential consequences. This is not to say that the strategy cannot be successful. However, it does require full and accurate disclosure.

In Closing

Selling Indexed Universal Life might be the best thing that ever happened to you. It can open-up doors to an entirely new client-base, or provide downside guarantees for existing clients who have previously been burned on securities products. However, it is important to understand the products completely before presenting them to a client. For many of the scenarios which were explained above, a misinformed agent or client can certainly have the potential for bringing complexity into the Indexed UL sales process. This is something that could be potentially disastrous for the entire Indexed Life market if it takes on a snowball effect.