FIO Calls States to Adopt Uniform Annuity Suitability Regulations

January 28, 2014 by Linda Koco

Every state should “adopt and enforce” the National Association of Insurance Commissioners’ (NAIC) Suitability in Annuities Transaction Model Regulation, according to the Federal Insurance Office (FIO).

Reading between the lines, the underlying message is that this is no time for foot-dragging. All states need to adopt and implement the NAIC suitability model ASAP. If all states aren’t on board fairly soon, the feds might step in.

The recommendation was part of a lengthy report that the federal researcher submitted to Congress in December. Required by the Dodd-Frank Act of 2012, the report examines ways to “modernize and improve” the insurance regulatory system in the United States.

The FIO is a research and recommendation agency under the U.S. Department of the Treasury. It was created under Dodd-Frank to, among other things, monitor the insurance industry, including any regulatory gaps that could contribute to systemic crisis.

The 71-page report makes numerous recommendations concerning hot button regulatory oversight issues such as solvency, capital standards, reserving, producer licensing, market conduct and more. Included are reforms that the FIO says the states “should” undertake, plus “areas for federal involvement” and a “hybrid approach to insurance regulation.”

Annuity suitability recommendation

The annuity suitability recommendation appears in the “marketplace oversight” section. It runs only 650 words, but annuity professionals will be perusing those words very carefully.

This is due, in part, to the high-profile role that the FIO seems to be assuming in the post-Dodd-Frank reform era – not as a regulator, but as a researcher/recommender with voice and authority. It is also due to the implied federal oversight nature of the annuity suitability recommendation.

“The suitability of an annuity purchase should not be dependent upon the state in which the consumer resides,” the FIO states.

“Given the importance of national suitability standards for consumers considering or purchasing annuities, states should adopt the Model Suitability Regulation. In the event that national uniformity is not achieved in the near term, federal action may become necessary.”

The last statement – that “federal action may be necessary” – will no doubt stir up a certain amount of industry murmuring.

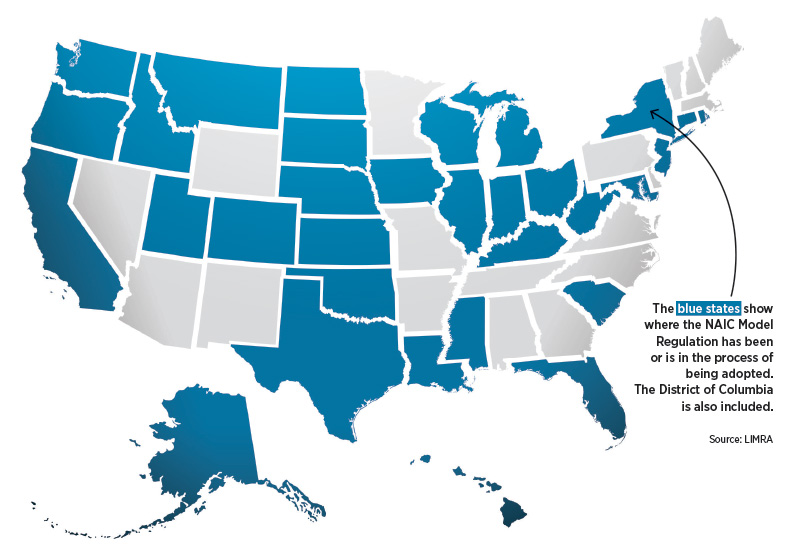

That is because, according to various published reports, many states have already adopted one version or another of the annuity suitability model developed by NAIC. “So why even bring this up?” some professionals will ask.

Apparently, this has to do with the lack of uniformity among those regulations. NAIC has adopted three versions of its suitability model over the years. The 2003 version applies to sales involving senior buyers. The 2006 version updates the model to apply to consumers of all ages. And the 2010 model substantially strengthens the standards (by clarifying insurer compliance and producer education requirements, for example).

Twenty-five states are said to have adopted the 2010 version, with more on the way. But the other states adopted the earlier versions or, in a few cases, they have entirely different suitability approaches in effect.

NAIC has put on a big push to spur the remaining states to adopt the 2010 version. But states handle NAIC model adoption in different ways and in accordance with their own laws. That means state adoption of this particular model, as with most models, has occurred over a period of years, not months.

Relative to that point, the FIO’s call for the states to achieve uniformity in the “near term” will be another source of concern. Annuity professionals and state regulators will ponder what “near term” means in this context. Within a few months? A year? Five years? When?

Looking for uniformity

From the discussion in the report, it appears that the FIO is recommending that the uniform adoption is to apply to the 2010 version of the model, not the earlier versions or the single-state versions.

The researchers do not say it exactly that way, but it’s implicit in the description the report provides for the NAIC suitability model. As the FIO describes it, the model requires:

- Insurance producers to have reasonable grounds for believing that the recommendation to buy an annuity is suitable for the consumer;

- Insurers to maintain procedures for the review of each recommendation to purchase an annuity to determine suitability prior to issuing the annuity;

- Insurance producers to be trained on the provisions of annuities generally; and

- A safe-harbor for variable annuity sales made in compliance with FINRA requirements.

Annuity industry professionals will recognize those characteristics as belonging to the 2010 annuity model.

To bolster its case, the FIO researchers point out that the Dodd-Frank Act has two sets of provisions that incorporate this suitability model.

One set of provisions essentially involves voluntary adoption. Here, the act provides “incentives” for state regulators to enact national suitability standards. These include grants for which states can apply to support efforts “to enhance the protection of seniors from misleading and fraudulent sales of financial products,” the researchers say.

The catch is, in order to obtain the grants, the states must meet certain requirements, including a requirement to “adopt suitability standards that meet or exceed” those in the model regulation. They could choose not to adopt the standards, but then they won’t qualify for the grants.

The second set of provisions moves closer to being an indirect requirement. Here, Dodd-Frank includes a direction to the Securities and Exchange Commission that involves both the suitability model and regulation of indexed annuities. This is the so-called Harkin Amendment, and it exempts indexed annuities from securities regulation.

To get the exemption, an indexed annuity must meet certain standards. One of the standards is that the annuity must be issued in a state that has adopted the suitability model or be issued by an insurer whose nationwide practices meet or exceed the suitability model standards.

Proposing hybrid regulation

The hybrid focus of the annuity suitability recommendation can be found in other recommendations throughout the FIO report.

As the FIO phrases it in the press release that accompanied publication of the report, “In some circumstances, policy goals of uniformity, efficiency and consumer protection make continued federal involvement necessary to improve insurance regulation.” But the FIO is proposing a hybrid model – one “where state and federal oversight play complementary roles.”