More Nonretired U.S. Investors Have a Written Financial Plan

August 5, 2015 by Jeffrey M. Jones

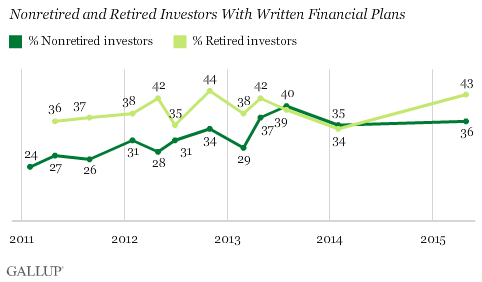

PRINCETON, N.J. — Thirty-eight percent of U.S. investors have a written financial plan to help them achieve their investment and retirement goals. Retired investors (43%) are more likely than nonretired investors (36%) to have a written financial plan, as is typically the case. However, the percentage of nonretired investors with a written plan is up significantly since early in 2011 (24%).

A financial plan typically consists of investors’ goals — commonly for retirement savings, but also for college savings, insurance needs, taxes and major purchases. Having a written plan with specific goals and formal steps to take should increase the likelihood that people will achieve those goals. Those without a formal written plan may instead have vague notions as to what their financial aims are and how to attain them. Still others may not have even thought about long-range financial matters.

In three separate surveys conducted in 2011, an average 26% of nonretired investors said they had a written financial plan. That increased to an average 31% in 2012 and 35% in 2013 and has been at about that level since.

There has been a very slight increase among retired investors since 2011, from an average 37% in 2011 to an average 39% since then.

The rise in the percentage of both non-retired and retired investors with written financial plans coincides with the long-running U.S. stock bull market, the drop in the U.S. unemployment rate, as well as generally improving confidence in the U.S. economy.

The results are based on the Wells Fargo/Gallup Investor and Retirement Optimism Index survey, conducted May 22-31. The survey defines investors as those with $10,000 or more in investable assets.

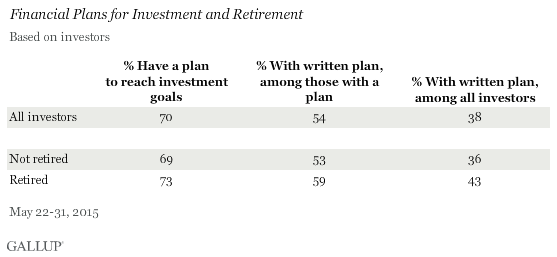

Overall, 70% of investors say they have a financial plan, but barely more than half of those with a plan, 54%, say it is a written plan. Those figures translate to 38% of all U.S. investors having a written plan. Retired investors are a bit more likely than nonretired investors to say they have a plan and to say it is a written plan.

Investors who do not have a written plan are most likely to cite a lack of time (29%) or not having thought about it (27%) as a reason they do not have a written plan. Another 18% say they do not find written financial plans to be useful.

Most Investors With Plan Follow It Closely, Are Confident in It

Having a financial plan is a key first step in reaching one’s investment goals, but those goals will likely be harder to achieve if investors do not follow the plan. The majority of investors with a written financial plan, 53%, say they follow that plan “very closely.” Another 39% say they follow it “somewhat closely.”

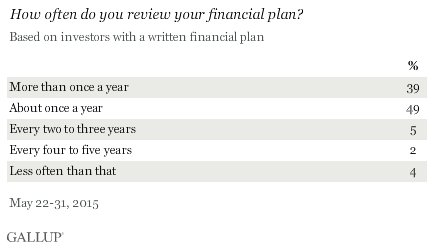

One way investors can keep on track with their financial plan is to review it on a regular basis. The vast majority of investors with a written financial plan, 88%, say they review it at least annually, including 39% who do so more than once a year.

Another way for investors to stay on track with their plan is to enlist the help of a professional adviser. The vast majority of investors with a written plan, 74%, say they developed the plan with the help of an investment adviser, including 80% of substantial investors and 61% of less substantial investors. Substantial investors are those with $100,000 or more of investable assets.

Investors with a written plan tend to be confident that it is adequately designed to help them reach their goals. Four in 10, 42%, are highly confident of this, with another 48% somewhat confident.

Retirement Is Common Focus of Financial Plans

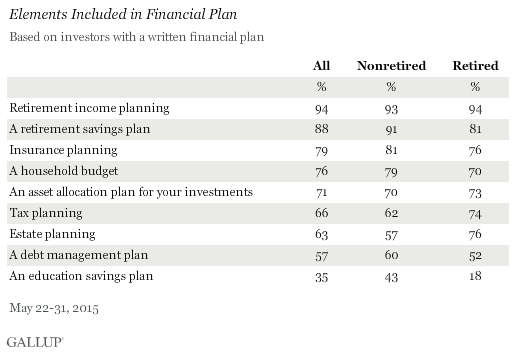

Nearly all investors with a written plan include retirement as a key component of their saving and investing plan. Ninety-four percent say their financial plan includes retirement income planning, and 88% say it includes a retirement savings plan.

After retirement, other key focus areas are insurance planning, a household budget and an asset allocation plan for investments. Reflecting the generally older age of investors, just 35% say their financial plan includes an education savings plan. Forty-three percent of nonretired investors have education savings as a component of their financial plan, compared with 18% of retired investors.

Retired (76%) and nonretired (57%) investors also differ in the extent to which their financial plan includes estate planning.

Implications

Although most U.S. investors say they have a financial plan, fewer than four in 10 have gone the extra step to develop a written financial plan. However, that percentage has been growing in recent years. A written plan is a key tool to help investors define their goals and spell out specific steps needed to achieve those goals. The act of developing a clearly defined written plan likely keeps investors more on track for their goals than if they did not have such a plan. Those who do have a written plan appear to be more committed to achieving their goals than those who do not have such a plan — most with a written plan have employed a financial adviser to help develop it, say they follow it at least somewhat closely and say they review it at least annually.

Survey Methods

Results for the Wells Fargo/Gallup Investor and Retirement Optimism Index survey are based on questions asked May 22-31, 2015, on the Gallup Daily tracking survey, of a random sample of 1,005 U.S. adults having investable assets of $10,000 or more.

For results based on the entire sample of investors, the margin of sampling error is ±4 percentage points at the 95% confidence level.

In addition to sampling error, question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of public opinion polls.