Proof Wall Street Is Still A Boys’ Club

March 14, 2017 by Ben Steverman

Last week a statue of a young girl was temporarily installed in New York’s Financial District to mark International Women’s Day. Called The Fearless Girl and sponsored by State Street Corp., she was depicted bravely facing off against the bronze bull that’s become a symbol of Wall Street.

A new study finds that, when it comes to truly celebrating women, Wall Street still has a long way to go. The results show that investment firms treat male employees very differently from female employees after they get in trouble. While women are far less likely to engage in misconduct, they’re punished much more harshly for any infractions.

Finance professors Mark Egan of the University of Minnesota, Gregor Matvos of the University of Chicago, and Amit Seru of Stanford University analyzed the misconduct records and employment patterns for 1.2 million U.S. financial advisers over a decade. The numbers are stark:

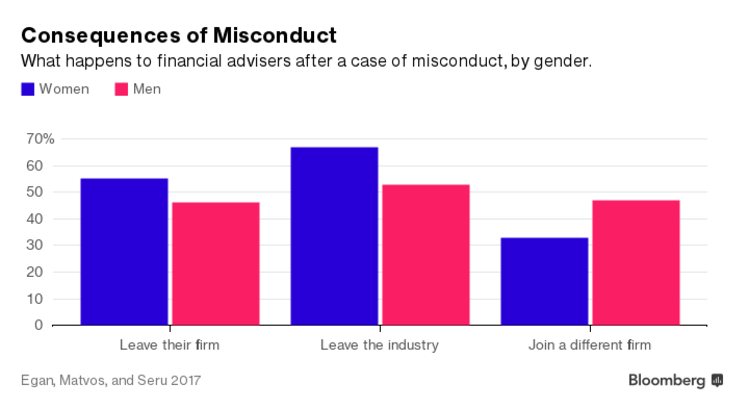

Male financial advisers are three times more likely to have a record of engaging in serious misconduct , with more than 9 percent crossing the line compared with 3 percent of female advisers. After misconduct is registered, however, “female advisers are 20 percent more likely to lose their jobs, and 30 percent less likely to find new jobs relative to male advisers,” they write.

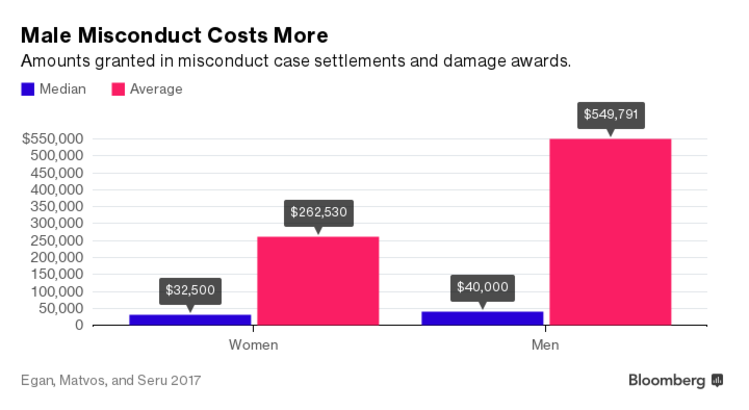

Are women getting fired more (and rehired less) because their misconduct is more serious? No. Misconduct allegations against men cost firms 20 percent more to settle. Also, male advisers are twice as likely to be repeat offenders. “Both of these results suggest that firms should punish male advisers more severely than female advisers,” the authors wrote.

Maybe firms are firing female advisers more often because those women are less valuable employees? Also not true, the researchers concluded. For one thing, firms with female owners or senior executives tend to treat male and female misconduct more equally. The authors also looked at data on the productivity of advisers. “Even after we control for those things, we find women are still punished more severely for misconduct,” Matvos said in an interview. “Women have a narrower margin of error for missteps.”

The results won’t shock many women in the investment business. Almost 88 percent of female financial professionals said in a 2014 survey that gender discrimination exists in their industry; Some 46 percent said discrimination happened at their firm.

“I’m not surprised,” said Pamela Sandy, the chair of the Financial Planning Association, who founded her own Cleveland-based advisory firm, Confiance LLC, in 2008. “We’re still living in a very misogynistic profession. The larger firms are very much a boys’ club.”

The data support the perception that, when something goes wrong, men are more likely to get a pass. Men are excused as “aggressive” or “driven,” while women are branded “a bad girl,” Sandy said. “Women are held to a higher standard.”

Firms seem to keep a closer eye on their female employees, too, the data suggest. Women are much more likely to be accused of misconduct by their own firms, while men are more likely to be accused by customers.

This study may worsen the public relations problem already facing financial advisers in the U.S. The gender discrimination data comes from the same database as a groundbreaking study released by the same scholars a year ago: Egan, Matvos, and Seru found that 7 percent of U.S. financial advisers have been disciplined for serious misconduct over the course of their careers. Only about half of advisers who commit misconduct lose their jobs, and many of those fired advisers find new jobs. At some firms, 15 percent or more advisers were found to have engaged in misconduct.

Former U.S. President Barack Obama spent the last years of his term trying to tighten regulations on financial advisers. The White House calculated that conflicts of interests cost U.S. investors $17 billion annually. President Donald Trump has said he wants to undo Obama’s so-called “fiduciary rule” before it takes effect this spring.

Only about a quarter of financial advisers are women, according to the new study. One way to improve how they’re treated on the job is to promote more women to leadership positions, it states. At firms with no female owners or executives, women were 42 percent more likely to be fired for misconduct than men. At firms in which men and women are equally represented in the executive suite, they are fired at equal rates after misconduct.

The study’s authors aren’t shy about naming names. They said that, among large firms, the highest rates of discrimination were at Wells Fargo Advisors LLC, a unit of Wells Fargo & Co. “Wells Fargo Advisors works every day to put our clients first,” the company said in a statement. “We will review this study carefully to examine its assumptions and conclusions. We will continue to focus on providing a diverse and inclusive work environment where all of our team members can thrive.”

Brokerage firms can’t just focus on hiring women—they must also feel included in the office, Sandy said: “I still hear from a lot of young women that say they still feel like an outsider in their firm.”

But even as Wall Street slowly moves toward equality, some continue to feed its darker reputation. Shortly after the Fearless Girl was set up in Lower Manhattan, a picture went viral of a young, well-dressed man in a business suit standing in front of the statue, pretending to have sex with it.

“That says it all,” Sandy said.

This article was provided by Bloomberg News