The World Isn’t Prepared for Retirement

May 29, 2018 by Suzanne Woolley

Most online quizzes are relatively mindless, promising to reveal what vegetable, sandwich or rock band best represents your personality. That was not the case for a short online test given to more than 14,000 people in 15 countries this year. It revealed just how unprepared a good chunk of the world is for retirement.

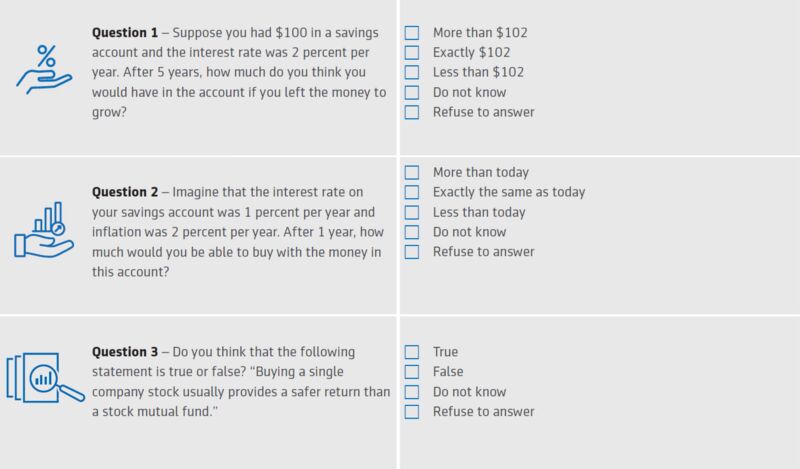

The three-question test, given as part of The Aegon Retirement Readiness Survey 2018, measured how well people understand basic financial concepts. Many of the participants failed the quiz, with big potential consequences for their future security.

Click HERE to view the original story via Bloomberg.

Beyond the sobering lack of financial literacy, there was some rather curious data in Aegon’s annual survey, published Tuesday. For example, some 20 percent of workers surveyed in China envisioned spending retirement with a robot companion. But before we get to that, take a look at this question—only 45 percent of people around the world got right:

Q. Do you think the following statement is true or false? “Buying a single company stock usually provides a safer return than a stock mutual fund.”

The possible answers? True, false, do not know and refuse to answer.

Sixteen percent of people got it wrong. “Do not know” was chosen by 38 percent. In the U.S., 46 percent of workers got it right. Good for you, America. (The answer, in case you were wondering, is false.)

It was an inflation question that had the highest percentage of wrong answers, however. More than 20 percent of workers didn’t grasp how higher inflation hurts their buying power. Given that declining health was the most-cited retirement worry, at 49 percent, and healthcare is an area (in the U.S., especially) with high cost-inflation, well, that makes the subject something older folks should have down cold.

The survey asked workers—about 1,000 per country—what global trends would affect their retirement plans. “Reduction in government retirement benefits” was the most popular answer worldwide, chosen by 38 percent globally; in America, it was 26 percent. The countries most worried about cuts to government benefits? Brazil and Hungary, at about 53 percent.

Concern with developing Alzheimer’s or dementia was cited by 33 percent globally. The highest percentage of people citing it as a worry were in Spain, at 53 percent. In the U.S., 31 percent were worried about it.

Across the board, though, workers didn’t seem to recognize the huge impact that basic changes in the labor force, technology and the climate will probably have on their retirement plans, said Catherine Collinson, president of the nonprofit Transamerica Center for Retirement Studies and executive director of The Aegon Center for Longevity and Retirement.

“It makes me wonder about the extent to which people are naive about the magnitude of the disruption in our world, and the level of change that has not only occurred, but is imminent,” said Collinson. “Is it that people don’t see it coming, or is it so overwhelming that people are in denial?”

Many workers may well be in denial about how long they can actually work. The survey found workers generally plan to retire around age 65. “The sobering reality is that 39 percent of retirees globally retired sooner than planned,” according to the report. “Of those, 30 percent stopped working earlier than they had planned for reasons of ill health, and 26 percent due to unemployment/job loss.”

And those robots? The survey asked about “aging friendly modifications or devices” people envisioned having in their homes. Thirty-five percent of workers in India, 34 percent of workers in Turkey and 18 percent in the U.S. figured aging could include video monitoring devices. Then there are the robots, which 20 percent of Chinese workers see coming in retirement, compared with 6 percent of American workers.

The report is intended as a call to action, said Collinson. Recommendations include working financial literacy into educational curriculums, promoting a more positive view of aging and allowing universal access to retirement savings arrangements.

With the traditional “social contract” between government, employers and individuals crumbling, “the sooner we roll up our sleeves and get to work, the sooner we will be able to identify and implement solutions,” she said. Whether that’s in public-private partnerships or implementing more findings from the field of behavioral finance, “inaction is really the enemy.”

Here’s the rest of the quiz. See how you do:

The “Big Three” financial literacy questions were created by Professors Annamaria Lusardi of the George Washington School of Business and Olivia Mitchell, of the Wharton School of the University of Pennsylvania.

Answers: Q1. More than $102 (compound interest). Q2. Less than today (inflation). Q3. False (diversification).