Introduction

You’re obviously here for a reason…

Annuities have been called “complex” by some. (NOT!) Actually, when you’ve got the lowdown on these retirement savings products, it’s pretty simple! *wink* Now— let’s assume that you don’t know what an annuity is. No worries. Most everyone knows what life insurance is, so let’s just start by making a comparison to life insurance.

- Life insurance protects against the risk of death, or dying too soon; if the insured person(s) die, the insurance company pays out a sum of money to one or more designated beneficiaries;

- An annuity is sometimes referred to as “the opposite of life insurance.” Annuities insure against the risk of life, or living too long; the insured person receives a stream of income they cannot outlive from the insurance company;

- With an annuity, the purchaser pays a premium to the insurance company. In exchange, they receive a regular stream of income payments from the insurer that begin either immediately, or at some time in the future. The payment stream continues until the purchaser dies- even if that occurs at age 127 ½!

- Heads up- an annuity is one of the tons of financial products that are available as a retirement income vehicle. You should work with a trustworthy professional when determining which of these vehicles best-suits your needs and retirement goals. Got it?

Hold on- before making this decision, you should also consider a fundamental principle of risk:

Risk/Reward Tradeoff- a direct inverse relationship between possible risk and possible reward, which holds for a particular situation. To realize greater reward, one must generally accept a greater risk, and vice versa.

In light of this fabulous tradeoff, there are three questions that must be answered, when researching what type of annuity is right for you.

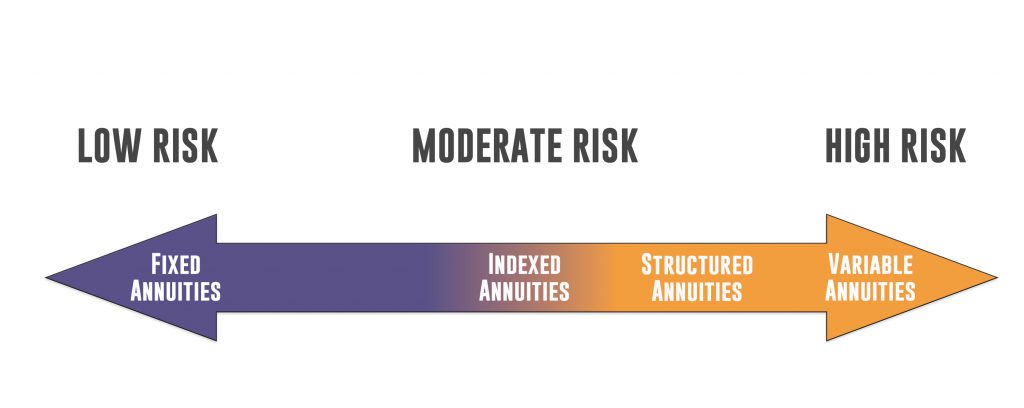

1. What level of risk am I willing to assume with the annuity?

- If most concerned about high minimum guaranteed interest, regardless of the lower level of interest crediting/gains, consider a Fixed Annuity.

- If willing to accept a lower minimum guarantee than a fixed annuity, but looking for potentially greater interest crediting/gains, consider an Indexed Annuity.

- If willing to accept no minimum guaranteed interest, and the possibility of unlimited loss in exchange for the possibility of unlimited interest crediting/gains, consider a Variable Annuity.

2. How soon will I need the regular stream of income payments from the annuity?

- If income will be taken within the first year, consider an immediate annuity (offered in Fixed, Indexed, and Variable types).

- If income will be taken at some time further in the future, consider a deferred annuity (offered in Fixed, Indexed, and Variable types).

3. How many premium payments will I be making into the annuity?

- If only a single payment will be made into the annuity, consider a single premium immediate annuity or a single premium deferred annuity.

- If making more than one payment into the annuity, consider a flexible premium deferred annuity.

Okay- got that part? There’s just a little bit more…

There are also two different classifications of annuities: deferred and immediate.

What is a deferred annuity?

An insurance product whereby at least a year will elapse between when the lump sum or series of premium(s) are paid, and the annuity is transitioned into a stream of income through annuitization. Deferred annuities can be Fixed, Indexed, or Variable in nature.

What is an immediate annuity?

An insurance product whereby a lump sum premium is paid and the annuity is transitioned into a stream of income through annuitization within one year from the date of purchase. Immediate annuities can be Fixed, Indexed, or Variable in nature.

Deferred annuities typically are used as vehicles for accumulation, or building additional interest until the annuitant is ready to transition the annuity to a series of payments through a process called “annuitization.” Alternatively, an immediate annuity is often used as a vehicle for individuals who are ready for their income stream to begin, well, immediately.

Both deferred and immediate annuities can have their interest credited in several different ways. The two basic types of deferred and immediate annuities are Fixed and Variable. Of the fixed variety, there are (traditional) Fixed, as well as Indexed.

Annuity Risk Spectrum

| Guaranteed Interest | Upside Potential | Indexed Participation | Client’s Risk Tolerance | |

| Fixed(Traditional) | Typically 1.00% | Very Limited: typically less than 5.50% | None | Low |

| Indexed | Typically 87.50% of premium @ 1.00% | Limited: typically capped at less than 9.00% | Gains based on the performance of an external index | Moderate |

| Variable | Fixed account only | Unlimited | Gains based directly on fund performance | High |

(NEWSFLASH: if a salesperson suggests that Indexed Annuities provide unlimited gain potential- RUN! This individual either misunderstands or is misrepresenting the product.)

Indexed Annuities provide limited gain potential and are not intended to perform comparably to securities products. Indexed Annuities merely credit interest based on the performance of stock market, commodities, or bond index. Don’t be confused; these annuities do not allow you to invest directly in the stock market. They do, however, provide the opportunity to outpace fixed money instruments such as Certificates of Deposit (CDs) or Fixed Annuities.

What is a Fixed Annuity (FA)?

A contract issued by an insurance company that guarantees a minimum interest rate with a stated rate of excess interest credited, which is determined by the performance of the insurer’s general account. Multi-Year Guaranteed Annuities (MYGAs), a type of Fixed Annuity, guarantee a minimum interest rate for more than a one-year period; this rate is also determined by the performance of the insurer’s general account. A Fixed Annuity is considered a low risk/low return annuity product.

What is an Indexed Annuity (IA)?

A contract issued by an insurance company that guarantees a minimum interest rate of zero, where crediting of any excess interest is determined by the performance of an external index, such as the Standard and Poor’s 500® index. An Indexed Annuity is considered a moderate risk/moderate return annuity product.

What is a Variable Annuity (VA)?

A contract issued by an insurance company that has no minimum guaranteed interest rate, where crediting of any excess interest is determined by the performance of underlying investment choices that the annuity purchaser selects. A Variable Annuity is considered a high risk/high return annuity product.

In your evaluation of annuities, it helps to understand the “300 foot view” of the annuity transaction. The sale of an annuity has to benefit the three parties to the annuity transaction:

- The annuity purchaser- via fair interest rate crediting/gains

- The annuity salesperson- via fair compensation

- The annuity issuer (insurance company)- via a fair profit, i.e. a spread

We refer to this as the “three-legged stool” of the annuity transaction. To fully understand, it also helps to consider how the insurance company makes money by selling annuities. Simplistically, the insurance company invests the annuity purchaser’s premium payment(s) in different investment vehicles, in order to make a return that is high enough to pay administrative costs (such as the salesperson’s compensation), credit interest to the annuity purchaser, and still retain a profit.

So, let’s consider an example, using Fixed Annuities as a point-of-reference.

- The Fixed Annuity purchaser submits a payment of $100,000 to the insurance company for her 10-year annuity;

- The insurance company invests the annuity purchaser’s premium payment in bonds (This ensures that they will receive a guaranteed return on the monies, and be able to pay the annuity purchaser a guaranteed interest rate);

- Assume that 10-year bonds are paying a rate of 4.00% to the insurance company;

- The insurance company then credits [4.00% – X] to the annuity purchaser’s 10-year fixed annuity contract [the value of X is determined by knowing what amount the insurer needs to cover their expenses (i.e. salesperson’s compensation) and the amount of profit the insurance company intends to keep].

Ta da! It’s that simple!

Now, with Indexed Annuities, the example above is only modified slightly.

- The insurance company still invests the annuity purchaser’s premium payment in bonds; but not 100% of it;

- The difference of less than 5% of the payment is used to purchase options (options are what give the insurance company the ability to credit interest to the annuity purchaser, based on the performance of a stock market index);

- The determinant in the rate that is credited to the annuity is: a) the cost of the option, and b) the stock market index’s performance.

So, we have established that there are several different types of annuities, the primary categories being Fixed and Variable. These products are very different, despite the fact that they both may be used for the same purpose. Not everyone has similar tastes after all (hence the exhaustive list of delicacies available at The Cheesecake Factory!).

Okay- so we’ve seen some of the likenesses in these products. So, what’s different?

Who sells this product?

Licensed insurance agents have the ability to sell Fixed, Indexed, and Multi-Year Guaranteed Annuities, as long as they have an active life and annuity line of authority within the state that they are selling in.

Even though Indexed Annuities earn interest based on the performance of a stock market or similar index, a securities license is not required to sell Indexed Annuities. They are fixed insurance products; the annuity purchaser is never directly invested in the stock index with an Indexed Annuity.

If a securities-licensed salesperson (i.e. someone who sells stocks, bonds, mutual funds, etc.) wants to sell Fixed, Indexed, or Multi-Year Guaranteed Annuities, they can do so by obtaining a life and annuity line of authority with their local state insurance commissioner’s office.

How is this product sold?

Fixed, Indexed, and Multi-Year Guaranteed Annuities, like other insurance products, are sold via an insurance contract. This document is 20 pages, give or take. By contrast, securities products (such as Variable Annuities) are sold via a prospectus; a document that is typically more than 100 pages. The fact of the matter is, if most American’s don’t read their mortgage paperwork, they’re not going to read these documents either. Sad and scary, but true.

When an insurance agent sells any variety of fixed annuity, the sales materials and product brochures will be accompanied by the following (at a minimum):

- Annuity application

- Annuity disclosure document

- Annuity suitability form

- Annuity Buyer’s Guide

More forms may be required depending on the state that the purchaser lives in, whether they are replacing another annuity or investment with the current annuity purchase, and/or whether the monies that are being used to purchase the annuity are coming from a qualified plan (just to name a few variables).

Who carries the risk with this product?

Fixed Annuity

The insurance company must pay out a minimum guaranteed rate of interest, regardless of what they earn on their investments with a Fixed Annuity. Let’s take a look:

- An annuity purchaser buys a Fixed Annuity with a minimum guarantee of 3.00%;

- The annuity is currently credited rate of 4.50%;

- If the market “tanks,” and the insurance carrier can only earn 2.00% on the money they have invested (i.e. on the bonds purchased by the insurer at the time the annuity was acquired), the annuity purchaser is still protected by the minimum guarantee of 3.00%;

- So, the insurance company holds the risk with a Fixed Annuity. The insurer still has to make good on the minimum guarantees in the contract, regardless of the performance of their own investments.

Indexed Annuity

The insurance company must pay out a minimum guaranteed rate of no less than 0%, regardless of what they earn on their investments with an Indexed Annuity. Let’s check it out:

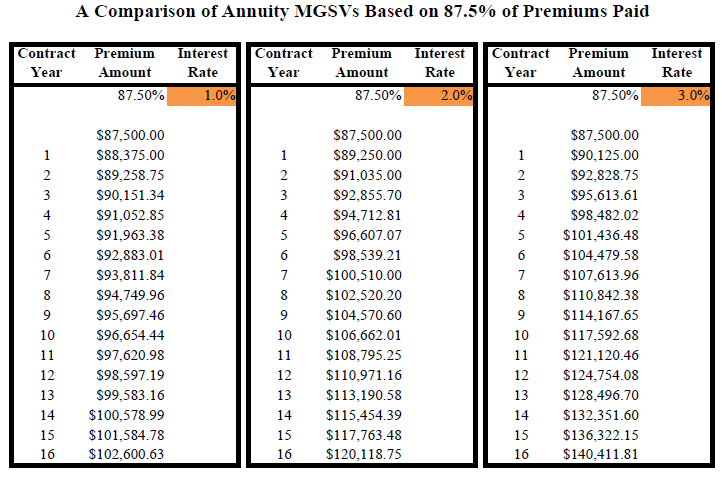

- The insurance company must offer a secondary guarantee on Indexed Annuities, in the event the annuity purchaser dies or cash surrenders the annuity, or even in the event the index does not perform;

- This guarantee is called the Minimum Guaranteed Surrender Value, or MGSV;

- An annuity purchaser obtains an Indexed Annuity with a MGSV of 87.5% of premiums, credited at 3.00% interest;

- On this annuity, the maximum credited interest may not exceed a cap of 8.00% if the S&P 500 rises 8.00% or more over a one-year period;

- If the market “tanks,” and the insurance carrier can only earn 1.00% on the money they have invested (i.e. on bonds purchased by the insurer at the time the annuity premium was paid), the annuity purchaser is still protected by the MGSV of 87.5% of the premiums paid accumulated at 3.00% interest (which accumulates to the point where a return of premiums paid would occur in the fourth contract year);

- So, the insurance company holds the risk with an Indexed Annuity. The insurer still has to make good on the minimum guarantees in the contract, regardless of the performance of their own investments.

Variable Annuity

The Variable Annuity purchaser chooses to directly invest in an array of available stocks, bonds, mutual funds, and underlying subaccounts on their annuity; any gain or loss is passed directly to the annuity purchaser in whole (less fees and charges). Let’s review:

- There is a potential for the annuity purchaser to experience a loss of principal and gains with a Variable Annuity, in the event of poor market performance;

- The variable sub-accounts have no minimum guaranteed interest, but the upside potential of a Variable Annuity is greater than that of Fixed and Indexed Annuities;

- An annuity purchaser acquires a Variable Annuity with a minimum guarantee of 1.00% only on the fixed subaccount, and no minimum guarantee on the variable subaccounts;

- Assuming 100% of the premiums are allocated to variable sub-accounts, if the market “tanks,” the insurance company bears no risk, but passes it directly to the annuity purchaser through a loss in their annuity’s value;

- So, the annuity purchaser holds the risk with a Variable Annuity. The insurer has no minimum guarantees to honor in the contract (they collect their fees and charges regardless of performance), and any negative performance on the underlying investments is fully-realized by the annuity purchaser.

Regulation

Heads up before you get deep into this regulation stuff- all financial services products have been used in the course of bad behavior, on the part of the salesperson, at one point or another. It is worth mentioning that the tool of the bad behavior is not the problem in such situations.

I liken this to a serial killer using a hammer to murder his victim and the government subsequently outlawing the use of hammers. That would make it difficult to complete tasks such as building homes and hanging pictures, but it would certainly eliminate people bludgeoning their victims with the tool. That being said, keep reading- you are doing GREAT!

Who regulates annuities? Is someone keeping tabs on these folks?

Fixed, Indexed, and Multi-Year Guaranteed Annuities (MYGAs) are fixed insurance products, and therefore regulated by state insurance laws and the insurance commissioners that enforce them.

- Insurance agents who want to sell Fixed and Indexed Annuities must obtain a life insurance license in the state where they are practicing;

- The insurance commissioner oversees the financial regulatory practices of the insurance industry as well as the solvency of the companies selling the products;

- Insurance companies, salespeople, and annuity purchasers go through their local state insurance department when they have questions or concerns about Fixed, Indexed, or MYG Annuities.

Variable Annuities are securities products, and thereby regulated by the Securities and Exchange Commission (SEC).

- Salespeople wanting to sell Variable Annuities must obtain a life insurance license in the state where they are practicing, as well as pass a securities exam(s);

- The insurance commissioner ensures the solvency of companies selling Variable Annuities;

- However- insurance companies, salespeople, and annuity purchasers go through the SEC when they have questions or concerns about Variable Annuities.

In the securities industry (where products such as Variable Annuities are sold), salespeople that are licensed to sell the products are regulated by the Financial Industry Regulatory Authority (FINRA) as opposed to the state insurance commissioner.

- FINRA is a self-regulatory organization that oversees the financial regulatory practices of the securities industry;

- In a nutshell, if you hold securities license, you must abide by the rules of the FINRA as well as the SEC, while the insurance commissioner oversees the solvency of the insurance companies you do business with.

Note that in the past, there have been a handful of Fixed and Indexed Annuities that have been filed as securities products and registered with the SEC, despite the fact that they are fixed insurance products. An insurance company’s logic behind doing this may be for several reasons. One reason an insurance company may register a fixed product as a security is to accommodate a distribution that is used to selling securities products (and the prospectuses that come with them). As a comparison, historical sales of registered Indexed Annuities have been nominal in comparison to total Indexed Annuity sales. Today, there are no registered Indexed Annuity products available for sale.

Both fixed and variable insurance products have tight regulation, and rules that the insurance companies and salespeople must abide by. The insurance company’s products, advertising materials, disclosures and training brochures are diligently reviewed in both the fixed and variable insurance markets. Salespeople are required to be properly licensed to sell both types of products. The market conduct of the marketing organization, broker/dealer, and salesperson are all carefully monitored, whether she/he is selling the Fixed, Indexed, or Variable variety of annuity.

The Battle Over the Securities Status of Indexed Annuities

SEC QUESTIONS IF INDEXED ANNUITIES SHOULD BE SECURITIES- PART I

In 1997, just two years after Indexed Annuities were introduced, the SEC first explored whether these products should be treated as securities (and subject to SEC regulation), as opposed to being treated as insurance (and therefore regulated by the NAIC).

Things you should know about this:

- The primary motivation for this inquiry was the SEC’s lack of information on the products; they earnestly didn’t know if Indexed Annuities were, or were not, securities;

- The SEC issued a concept release, requested promotional materials explaining the products, and ultimately took no action on the matter;

- At the time, the insurance industry assumed the lack of action to mean that the SEC had decided that Indexed Annuities were not securities;

- The insurance industry’s understanding of the products’ regulatory framework also led them to believe that Indexed Annuities were insurance:

- The purchaser’s principal and gains were protected from any losses due to stock market volatility in an Indexed Annuity, unlike securities products;

- Indexed Annuities met the three criteria for the SEC’s Section 3(a)(8) exemption from securities regulation. This exemption was determined eight years before Indexed Annuities were ever introduced and indicated that a product was not subject to SEC regulation if

- the annuity contract was subject to supervision by the state insurance commissioner;

- the insurer assumed the investment risk under the annuity (as opposed to the purchaser); and

- the annuity was not marketed primarily as an investment.

For these reason, it was believed that Indexed Annuities were fixed insurance products, not securities- particularly when the SEC took no action in 1997.

FINRA’S NOTICE TO MEMBERS 05-50

Several years later, in August of 2005, FINRA (then known as the National Association of Securities Dealers, or NASD) issued the “Notice to Members 05-50.” This is separate from, but related to, the previous discussion:

- This notice suggested that broker/dealers (B/Ds) treat Indexed Annuities as if they were securities, despite their fixed insurance status;

- FINRA justified their notice based on their belief that Indexed Annuities might one day be treated as securities, despite the fact that they were treated as insurance at the time the notice was issued;

- For salespeople not selling securities products, NTM 05-50 did not affect their sales practices;

- Alternatively, annuity salespeople with securities licenses were forced to change their sales practices in regard to Indexed Annuities; all sales of Indexed Annuities were to go through their broker/dealer forthwith;

- This meant that a salesperson’s B/D needed to approve the fixed insurance product that he wanted to offer his client, despite the fact that FINRA had no regulatory authority over Indexed Annuities; Regardless, salespeople holding securities licenses must abide by the rules of FINRA;

- Therefore, B/Ds began the task of overseeing Indexed Annuity sales for their registered representatives in August of 2005, and still oversee them to this day.

SEC QUESTIONS IF INDEXED ANNUITIES SHOULD BE SECURITIES- PART II

In June of 2008, the SEC began a second inquiry on the matter of whether, or not, Indexed Annuities should be regulated as securities with proposed Rule 151A. The SEC’s proposition was the result of years of negative and inaccurate media being published on Indexed Annuities. Here’s the short and sweet of this battle:

One of the primary reasons that Indexed Annuities have received negative media attention is because of their perceived complexity.

- In an effort to differentiate the many products that are available for sale today, insurance companies have invented new methods of calculating potential interest crediting;

- At times, these methods are overwhelming to both the salesperson and the annuity purchaser;

- However, 99.8% of the crediting methods available on Indexed Annuity products are based on very simple math (point-to-point, monthly and daily averaging, and fixed strategies). It’s the other 0.2% of the strategies out there that get folks confused once in a while…

Adding fuel to the media fire is that fact that some annuity salespeople have used Indexed Annuities in the course of bad behavior. These individuals’ suggestions of unsuitable annuity products resulted in some annuity purchasers being taken advantage of. Overall, this resulted in observers making the inaccurate assumption that all Indexed Annuities are “bad,” or used to take advantage of seniors.

Mistakenly, the insurance industry did not foresee media outlets’ disparaging and erroneous statements to be an immediate threat to Indexed Annuities; it was merely considered the newspapers and magazines’ attempts to cater to their advertisers. These advertisers sold securities products (such as mutual funds and stocks), therefore no one expected the media to sing the praises of products their advertisers competed against. This folly, coupled with a lack of publicly-available, credible information on Indexed Annuities, eventually resulted in the SEC declaring that the products should fall under their purview per Rule 151A. (Not anymore! Wink is here to save the day!!)

After a two-year battle waged with regulators, litigators, and legislators, the insurance industry secured the fixed insurance status of Indexed Annuities indefinitely.

- In the end, it was an act of Congress that settled the matter;

- In July of 2010, President Barack Obama’s signed the Dodd-Frank Wall Street Reform and Consumer Protection Act, which contained Senator Tom Harkin’s (D-IA) Congressional amendment detailing and dictating Indexed Annuities’ permanent insurance regulation.

Closing Thoughts

Now you should understand what an annuity is, who can sell them, and who regulates them. You should also understand quite clearly, what an annuity is not. Fixed, Indexed, and MYG Annuities are not alternatives to Variable Annuities, stocks, bonds, or mutual funds; these products are “risk money places.” Fixed, Indexed, and MYG Annuities are more accurately classified as “safe money places,” and generally viewed as an alternative to CDs, or other fixed-rate savings instruments. Is an annuity right for you? Only YOU can decide.

Annuity Rates

Fixed Annuities have an interest rate that is declared annually by the insurance company. Multi-Year Guaranteed Annuities are like traditional Fixed Annuities in that their interest rate is also declared by the insurance company. However, Multi-Year Guaranteed Annuities’ interest rates are guaranteed for longer than a one-year period. Guarantee periods on these annuities may range anywhere from two to ten years.

Most Indexed Annuities today offer some form of fixed bucket strategy. This would be a premium allocation option that receives credited interest in a manner like that of a traditional Fixed Annuity. A declared rate is set for the fixed strategy, and the annuity purchaser receives that rate if the annuity is held for the strategy term (usually one year). Most Variable Annuities also offer a fixed bucket for clients desiring a more conservative allocation mix. However, the line between Fixed, Indexed, and Variable is drawn when it comes to differentiating how the non-guaranteed rates are credited on these products.

Remember that with a Fixed Annuity, the insurance company declares a stated credited rate for the non-guaranteed, current interest rate. A Variable Annuity is very different in that the insurance company does not limit the potential gains of the product; the client is investing directly in the market. Therefore, a Variable Annuity purchaser may realize a gain of 18.00% if the fund they invested in grows that much over a one-year period. With an Indexed Annuity, the insurance company purchases options based on an external index’s performance, and the annuity purchaser receives non-guaranteed, current interest that is limited in growth (based on the option price).

Like the handful of crediting methods that can be confusing on some Indexed Annuity products, the pricing levers that are used to determine the actual rate credited can perplex others. There are three simple pricing levers that are used when calculating potential interest on Indexed products:

- Participation Rate—the percentage of positive index movement in the external index that will be used in the crediting calculation on an indexed product. (Note that a product with a Participation Rate may also be subject to a Cap and/or Spread.)

- Cap—the maximum interest rate that will be used in the crediting calculation on an indexed product. (Note that a product with a Cap may also be subject to a Participation Rate and/or Spread.)

- Asset Fee/Spread—a deduction that comes off of the positive index growth at the end of the index term in the crediting calculation on an indexed product. (Note that a product with a Spread may also be subject to a Participation Rate and/or Cap.)

Now that all of the disclaimers are aside, it can simply be said that most indexed strategies that have 100% Participation utilize a Cap as the pricing lever. In turn, most indexed strategies that have less than 100% Participation utilize the Participation Rate as the pricing lever. There are also trends among indexed crediting methods; averaging strategies tend not to have Caps more often than others, and utilize Spreads more frequently. Annual point-to-point methods generally utilize the Participation Rate or a Cap to limit potential indexed gains.

It is really quite simple when you break it down. For example, on an Indexed Annuity over a one-year term where the S&P 500® has experienced an increase of 20%:

- A Participation Rate of 55% would afford the client potential indexed crediting of 11% (20% x 55% = 11%)

- A Cap of 8% would pass on potential gains of 8% to the client (20% limited by an 8% cap)

- A Spread of 3.00% would leave the client with 17% interest credited (20% – 3% = 17%)

Typically, an Indexed Annuity utilizes only one pricing lever on each strategy. This means that when the insurance company changes the annuity’s rates, or the contract comes upon the policy renewal, only the one pricing lever will be adjusted upward or downward. However, an insurance company may reserve the right to adjust more than one pricing lever in the event of declining rates. This does not necessarily mean that they alter more than one pricing lever by practice. Generally, the less “moving parts,” the easier the product is to convey to both the salesperson and the purchaser. For that purpose, insurance companies try to limit the number of variables needed to describe each crediting method. It is important to note that there are a handful of products that use a moving part that is unique specifically to that product. These are just other pricing levers where potential interest crediting has been limited.

Indexed Annuities are also like Fixed Annuities in that they have minimum guarantees to protect the purchaser from a downturn in current credited rates or Caps, etc. Fixed and Multi-Year Guaranteed Annuities generally offer a minimum guaranteed floor of 1.00% or more. Indexed Annuities offer a guaranteed floor of no less than 0.00%. In addition, Indexed Annuities have a secondary guarantee that is payable in the event of death, surrender, or if the external index does not perform. This secondary guarantee is referred to as a Minimum Guaranteed Surrender Value (MGSV); it credits a rate of interest between 1% and 3% on a percentage of the premiums paid in to the annuity.

MGSVs can be stated in two methods: as Account Value guarantees, which must deduct the surrender charges from the calculation, or as Surrender Value guarantees, which are net of the surrender charges on the contract. An Indexed Annuity with a first-year surrender charge of 10%, and an Account Value guarantee of 100% @ 3% may be equivalent to the Surrender Value guarantee of a second product with an MGSV of 90% @ 3%. (100% – 10% surrender charge = 90%).

When Indexed Annuities first emerged in 1997, their MGSVs were often based on 90% of premium, credited at 3% interest; i.e. 90% @ 3%. However, when market conditions began declining and insurance companies weren’t able to offer indexed products with these guarantees, we saw MGSVs drop as low as 65% @ 3% for first-year premiums. It is important to note that annuity MGSVs most adhere to state Standard Non-Forfeiture Laws (SNFL), which are enforced by the state insurance departments. Today, more than three quarters of Indexed Annuity products have MGSVs that are based on 87.5% of premiums, and credited interest is based on the 5-year Constant Maturity Treasury rate (a rate between 1 – 3%). Today, annuity MGSVs cannot be less than 87.5% of premiums paid, credited at 1% interest.

Another very important rate to consider when evaluating which product to purchase, whether Fixed or Indexed, is the renewal rates. These are the new interest crediting rates, Caps, Participation Rates, etc. that are declared at the end of the interest crediting term (typically one year). So many products today are copied off of another popular insurance company’s product. If you want to evaluate the annuity beyond the contractual features, and the service and integrity of the insurance company; renewal rates should be taken into consideration. That being said, renewal rates are one of the most difficult pieces of information to get your hands on. A scant number of insurance companies feel that their renewal rates are an integral part of their sales story, and actually publish marketing pieces publishing these rates. This gives the potential annuity purchaser an idea of what the insurance company may do to the future rates on the product that they purchase, based on past renewal rate histories.

If you do not have access to renewal rates, it may be helpful to research Fixed and Multi-Year Guaranteed Annuities’ minimum guarantees and an Indexed Annuity’s minimum Participation Rates and Caps, as well as their maximum Spreads. These can be an indicator of just how low the insurance company could reduce the rates on the product after it is purchased. Note however, that due to policy filing efficiencies, many insurance companies opt for unusually low rate guarantees, Participation Rates and Caps, and rather high Spreads. (This avoids the cost of potentially re-filing the product in the event that market conditions decline, forcing the insurer to dramatically lower rates.) Often, salespeople are surprised when they see the maximums and minimums on the pricing levers for Indexed Annuities in particular. From a marketing standpoint, it is important to remember that the insurance companies would most likely discontinue selling the product(s) before rates were ever reduced to these minimums/maximums.

Crediting Methods

Point-to-Point Methods

- Annual Point-to-Point

- Two-Year Point-to-Point

- Term End Point

- Monthly Point-to-Point

- Point-to-Point with Low Watermark Features

- Point-to-Point with High Watermark Features

Averaging Methods

- Quarterly Point-to-Point

- Monthly Averaging

- Rolling Monthly Averaging

- Daily Averaging

Fixed Methods

- Fixed

- Fixed Rate with an Equity Kicker

- Fixed with Multi-Year Guarantee

- Performance Triggered

Other Methods

- Declared Rate/Equity Blend

- Multi-Index and Rainbow crediting methods (a subset)

History of Annuities

The Very First Annuity

1100 – 1700 B. C. Archeologists reveal that the legal codes of Egypt provide evidence that an annuity was purchased by a Prince ruling in Sint, in the Middle Empire.

The First Fixed Annuity

1759— A Pennsylvania company offers the first annuity in America to Presbyterian ministers and their families.

Traditional Fixed Annuities NOW

At the close of 2020, Traditional Fixed Annuity sales were $2.0 billion for the year.

Multi-Year Guaranteed Fixed Annuities NOW

At the close of 2020, Fixed Annuity sales were $52.3 billion for the year.

The First Indexed Annuity

February 15, 1995—Keyport (now Delaware Life Insurance Company) sold the KeyIndex Annuity for a premium of $21,000. Over a 5-year period the annuity grew to a value of $51,779. The average CD at the time would have returned $27,554 over the same five-year period, had the client continually renewed it.

Indexed Annuities NOW

At the close of 2020, Indexed Annuities sales were $58.1 billion for the year.

Non-Variable Deferred Annuities NOW

At the close of 2020, all Non-Variable Deferred Annuity sales were $112.5 billion for the year. Non-variable deferred annuities include the indexed annuity, traditional fixed annuity, and MYGA product lines.

The First Structured Annuity

October 4, 2010—AXA Equitable Life Insurance Company (Equitable Holdings Inc.) launched Structured Capital Strategies B

Structured Annuities NOW

At the close of 2020, Structured Annuity sales were $17.3 billion for the year.

The First Variable Annuity

1952— TIAA-CREF sold the first Variable Annuity for use in college and university qualified retirement plans.

Variable Annuities NOW

At the close of 2020, Variable Annuity sales were $72.4 billion for the year.

Variable Deferred Annuities NOW

At the close of 2020, Variable Annuity sales were $96.5 billion for the year. Variable deferred annuities include the structured annuity and variable annuity product lines.

All Deferred Annuities NOW

At the close of 2020, All Deferred Annuity sales were $209.1 billion for the year.